1. Parents will help me - I´ll move back with my parents and sell up. Do they have a lot of savings? Would you want that money to be used when it could / should be used for their own retirement?

- Are your parents prepared to cover all costs (mortgage, childcare, utilities etc)?

- Do you want your parents to take on your responsibilities?

- Would you want your parents to spend their money on you when they could be enjoying retirement?

- Would you really want to live with your parents again? Would they really want to live with you again? After working so hard to get here

- Would you really want to lose your independence and your hard-earned home for the sake of a gamble?

- Have you thought what would happen if your parents weren't there or couldn't help you when you needed it most?

- You've spent so long providing your own home, do you really want to have to give it up and all the time be thinking I wish I'd listened to my adviser?

- Without a crystal ball, you could be selling at the mercy of the market, and just as importantly, your need to release yourself from your liabilities could force you to sell at the wrong time and the wrong price.

2. State will provide

- The state will only give you £109.40 per week for up to 28 weeks. I am sure you will agree they cannot be relied upon to maintain your lifestyle should the worst happen.

- Have you had experience where someone has been supported through all their bills and mortgage by the state?

- Have you ever looked into state benefits in detail ? Let us explain them to you and what you may be entitled.

3. Too young / healthy

- Do you realise that the older you are before sorting, the more expensive this will become?

- The average claim for a Critical illness is 43, we're looking at 25+ years for your mortgage and we're also looking at guaranteeing no premium cost increase.

- Better to have and not need that to not have and need. We don't have a crystal ball for the next 25 years. Costs are so much less the younger you are. Great you're fit and healthy, but no one can see the future..

4. I will do it myself online

- Cheapest isn't necessarily the best.

- FOL WEALTH can give you a personal recommendation while you're here as to what you will need.

- We are here to provide advice and recommendation. The advice is free and something you can't get by going direct.

- We can make sure that all information is correct, not just at application but at claim to make sure all is disclosed.

- We're here to help you with advice, the arranging and should you need, claim. It's not just for now, it's for the long term.

- We can help and advise you with it all so that there are no mistakes. offer you an advised sale for peace of mind.

5. I´m self employed - i will still get my income

- We don't know what's around the corner, will the rest of the staff support you?

- Can you carry on the business through a long-term health issue or if you're housebound?

- Are you not the business though? Without you it will fall apart.

- I'm sure if you had something that was affecting your business then you would pay for that, so why not look at this as a potential employee payment, just that the employee comes in to pay for you should you be off ill.

6. You won´t pay out:

- We use a panel of providers who all pay out in excess of 94% of the time.

- If we ask the medical questions and go through them together, we can make sure that everything is covered and there will be no non-disclosure. A large percentage of claims not being paid is due to non-disclosure.

- We have the "Confirm your Details" form, that means that should you think of anything else that may be relevant, then it can be added.

7. Too expensive:

- Let's look at your overall costs Vs your current costs.

- If you can't afford this, are you really sure that you can afford the mortgage?

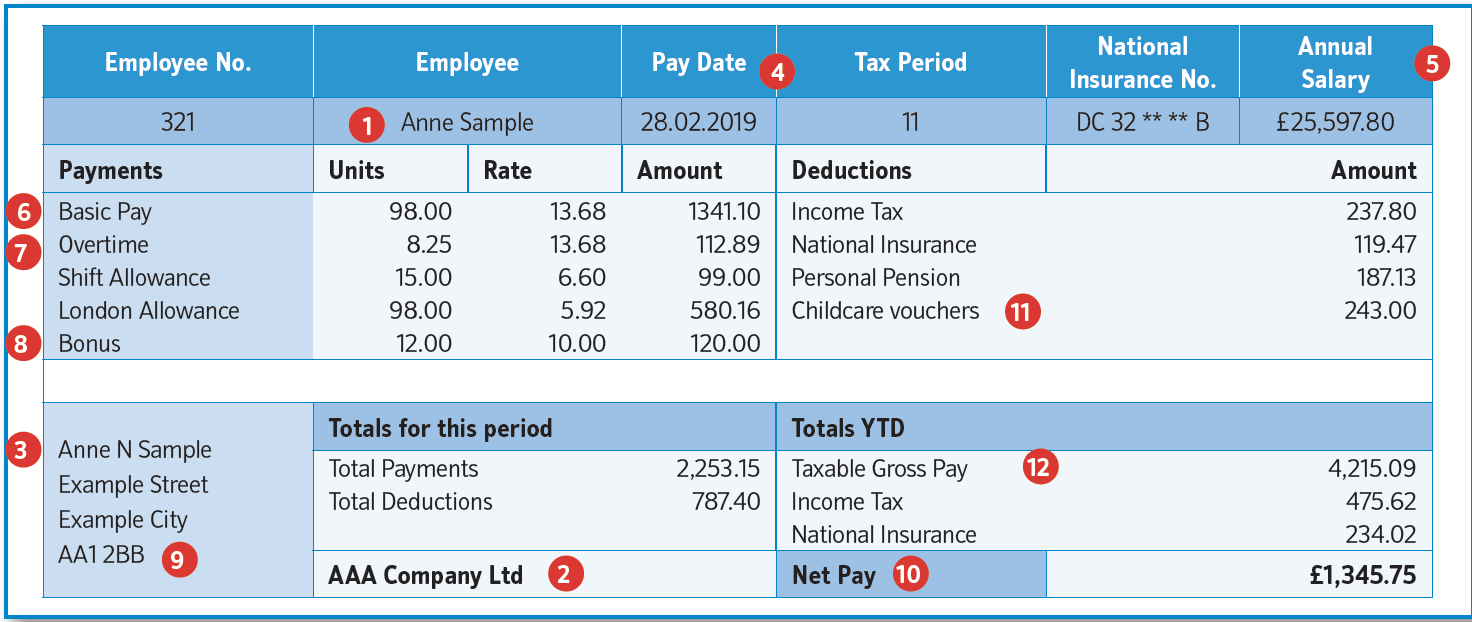

- We only recommend 5 stars Defaqto products.

- I know you understand the importance of the protection, this will cover large amounts for the long term.

- A small price to pay for peace of mind.

- The premium is not the problem, the premium is the solution.

8. Already sorted:

- Your needs may well have changed since then, let's take a look at what you need right now and see how that compares.

- How often has it been reviewed? When was the last time it was reviewed?

- It may well be ok, but it's our job to make sure.

Still not sure? Speak with any of our protection specialist or our Chartered Financial Planner, Abi Ladele, who will be happy to help you prioritise your current existing commitments.